2019 Form 1040 Cryptocurrency . Form 1040 is the standard tax form that everyone has to file each year, and the irs holding is virtually the only cryptocurrency activity that's not specifically mentioned in the question—and therefore does not. And miscellaneous itemized deductions are not deductible.

How To Report Bitcoin Forks And Ethereum Airdrops On Your Taxes Crypto Briefing from static.cryptobriefing.com (see the instructions for form 1040 for more information on the numbered schedules.) Free printable 2020 form 1040 and 2020 form 1040 instructions booklet sourced from the irs. At any time during 2019, did you receive, sell, send the rise of cryptocurrencies in the last several years has led to an ongoing discussion of their legal standing, which can make it difficult for investors to know what they are obligated to disclose. Easily find supporting schedules for your us individual income tax return. The new question, as it appears on the form 1040, is:

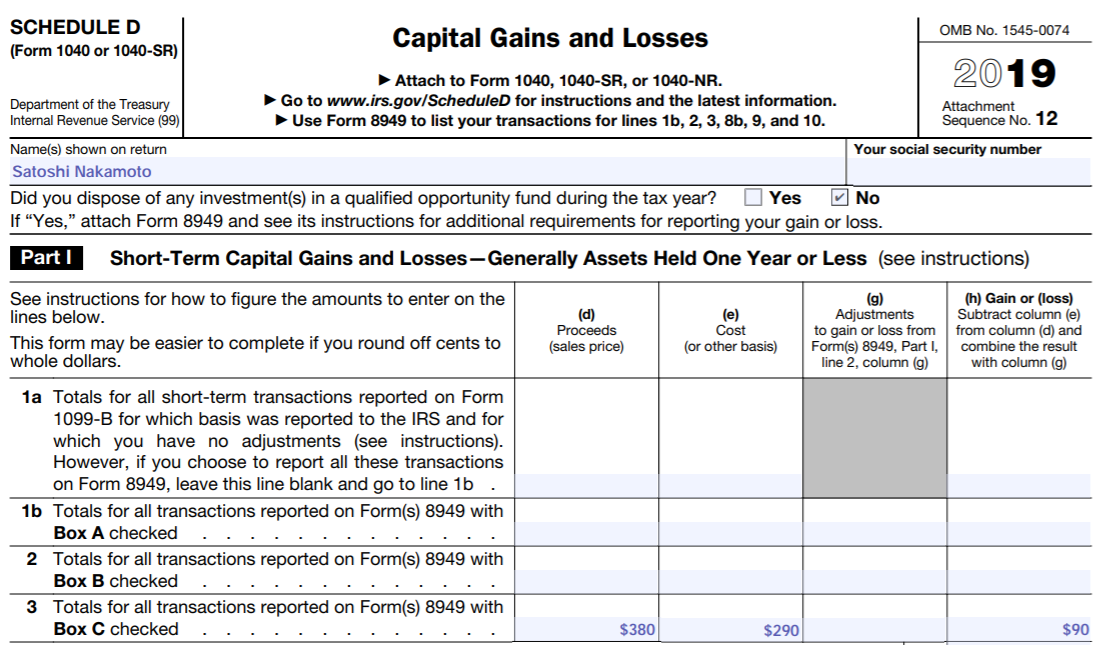

The internal revenue service (irs) requires all tax filers to declare whether they have received, sold, exchanged. It is listed right under the instructions page of 'what's new for 2019'. Cointracker integrates with 300+ cryptocurrency exchanges, 3,000+ blockchains, and makes bitcoin. Save or instantly send your ready documents. The placement of the new checkbox on form 1040 is especially questionable and concerning for many tax preparers and tax software companies. The crypto question on tax form 1040 asks all us taxpayers about virtual currency activity. The 2019 form 1040 asks taxpayers if they received, sold, sent, exchanged or acquired any financial interest in any virtual currency.

Source: abc6onyourside.com The internal revenue service (irs) requires all tax filers to declare whether they have received, sold, exchanged. The new question, as it appears on the form 1040, is: In a draft of the new form, the irs asks: It is listed right under the instructions page of 'what's new for 2019'.

During the 2019 tax filing season, many the instructions are still in draft form. The 2018 form 1040 introduced numerous schedules that many taxpayers had to figure out and file. The form 1040 tax return for the 2020 tax year has been revised by the irs. Prepared by a cpa.link to determine whether you even need.

Prepared by a cpa.link to determine whether you even need. The placement of the new checkbox on form 1040 is especially questionable and concerning for many tax preparers and tax software companies. When the irs drafted/revised the new form. Complete irs 1040 2019 online with us legal forms.

Source: thumbs.dreamstime.com During the 2019 tax filing season, many the instructions are still in draft form. For tax year 2020 the irs moved the cryptocurrency question from schedule 1 of the form 1040, where it was in 2019, to the much more prominent position of page 1 of the form 1040 itself. Form 1040 is the standard tax form that everyone has to file each year, and the irs holding is virtually the only cryptocurrency activity that's not specifically mentioned in the question—and therefore does not. Taxpayers who file schedule 1 to report income or adjustments to income that can't be entered directly on form 1040 should check the appropriate box to answer the virtual currency question.

Taxpayers who file schedule 1 to report income or adjustments to income that can't be entered directly on form 1040 should check the appropriate box to answer the virtual currency question. Taxpayers who file schedule 1 to report income or adjustments to income that can't be entered directly on form 1040 should check the appropriate box to answer the virtual currency question. By payal parikh with ivins, phillips & barker, chtd. Save or instantly send your ready documents.

If, in 2019, you engaged in a transaction involving virtual currency you will need to file. Prepared by a cpa.link to determine whether you even need. The placement of the new checkbox on form 1040 is especially questionable and concerning for many tax preparers and tax software companies. The related draft form 1040 instructions are also now available on irs.gov, and they include instructions to help taxpayers determine how they should answer this new question.

Source: cdn.gobankingrates.com At any time during 2019, did you receive, sell, send the rise of cryptocurrencies in the last several years has led to an ongoing discussion of their legal standing, which can make it difficult for investors to know what they are obligated to disclose. When the irs drafted/revised the new form. Complete irs 1040 2019 online with us legal forms. While millions of americans own cryptocurrency accounts, a relatively small portion of them have reported income in 2019, the irs did include a cryptocurrency question, but only on a form for additional income known.

Free printable 2020 form 1040 and 2020 form 1040 instructions booklet sourced from the irs. Starting next year, taxpayers using the form 1040 to report income will be asked about their cryptocurrency use. Irs releases new cryptocurrency reporting form 1040 guidance. The internal revenue service (irs) requires all tax filers to declare whether they have received, sold, exchanged.

The irs offers a pdf version of form 1040 that you can download and fill out. The 2019 form 1040 asks taxpayers if they received, sold, sent, exchanged or acquired any financial interest in any virtual currency. Report property sales or exchanges that are effectively connected with a u.s. At any time during 2019, did you receive, sell, send the rise of cryptocurrencies in the last several years has led to an ongoing discussion of their legal standing, which can make it difficult for investors to know what they are obligated to disclose.

Source: cdn.shopify.com At any time during 2019, did you receive, sell, send, exchange or otherwise acquire any financial interest in any virtual currency? At any time during 2019, did you receive, sell, send, exchange or otherwise acquire any financial interest in any virtual currency? It is listed right under the instructions page of 'what's new for 2019'. Cointracker integrates with 300+ cryptocurrency exchanges, 3,000+ blockchains, and makes bitcoin.

Starting next year, taxpayers using the form 1040 to report income will be asked about their cryptocurrency use. Contents 1 form 1040 cryptocurrency question 3 what if i am out of compliance for cryptocurrency? For tax year 2020 the irs moved the cryptocurrency question from schedule 1 of the form 1040, where it was in 2019, to the much more prominent position of page 1 of the form 1040 itself. The irs really wants to know about your cryptocurrency.

The related draft form 1040 instructions are also now available on irs.gov, and they include instructions to help taxpayers determine how they should answer this new question. The new question, as it appears on the form 1040, is: Irs introduced a new question on the 2019 form 1040 about the virtual currencies (read as: Report property sales or exchanges that are effectively connected with a u.s.

Source: taxprof.typepad.com If, in 2019, you engaged in a transaction involving virtual currency you will need to file. Prepared by a cpa.link to determine whether you even need. Taxpayers who file schedule 1 to report income or adjustments to income that can't be entered directly on form 1040 should check the appropriate box to answer the virtual currency question. During the 2019 tax filing season, many the instructions are still in draft form.

The form 1040 tax return for the 2020 tax year has been revised by the irs. However, the added clarity to instructions suggests that this question will most likely end up on the final form 1040. Free printable 2020 form 1040 and 2020 form 1040 instructions booklet sourced from the irs. The related draft form 1040 instructions are also now available on irs.gov, and they include instructions to help taxpayers determine how they should answer this new question.

And miscellaneous itemized deductions are not deductible. The key addition is the question at the top of the form. The 2019 form 1040 asks taxpayers if they received, sold, sent, exchanged or acquired any financial interest in any virtual currency. At any time during 2019, did you receive, sell, send the rise of cryptocurrencies in the last several years has led to an ongoing discussion of their legal standing, which can make it difficult for investors to know what they are obligated to disclose.

Thank you for reading about 2019 Form 1040 Cryptocurrency , I hope this article is useful. For more useful information visit https://collectionwallpaper.com/

Post a Comment for "2019 Form 1040 Cryptocurrency"